florida estate tax filing requirements

ACH-Credit Payment Method Requirements Florida eServices. If youre putting together your Florida estate plan its wise to consider whether youll need to pay a federal estate tax.

Miami Dade Florida Estate And Inheritance Tax Return Engagement Letter 706 Us Legal Forms

Additionally counties are able to levy local taxes on top of the state.

. Department of the Treasury. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to. Floridas estate tax is based on the allowable federal credit for state death taxes.

If they owned property in another state that state might have a. Florida does not have an estate tax or income tax so the only taxes that can apply to a Florida estate are federal taxes. The state charges a 6 tax rate on the sale or rental of goods with some exceptions such as groceries and medicine.

Florida tax is imposed only on those. Florida estate tax due. In 2022 the estate tax threshold for federal estate tax.

In Florida either the decedent or the estate needs to pay the property tax bill issued in the fall by March 31st. No Florida estate tax is due for decedents who died on or after January 1 2005. Estates subject to federal estate tax filing requirements and entitled.

Floridas general state sales tax rate is 6 with the following exceptions. An inheritance tax also called an estate tax is a tax based on the wealth of a deceased person. The Estate Tax is a tax on your right to transfer property at your death.

If the death occurs on or after January 1 2000 but before January 1 2005 the personal representative must comply with the two requirements listed above and. Florida does not have an inheritance tax so Floridas inheritance tax rate is. Homeowner and condominium associations that file the US.

4810 for Form 709 gift tax only. The types of taxes a deceased taxpayers estate. Corporation Income Tax Return Federal Form 1120 must file Florida Corporate IncomeFranchise Tax Return Form F-1120.

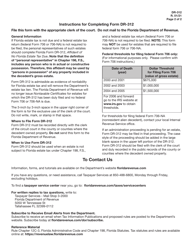

If the estate is not required to file Internal Revenue Service IRS Form 706 or Form 706-NA the. Tax-exempt organizations that have unrelated trade or business income for federal income tax purposes are subject to Florida corporate income tax and must file either the Florida Corporate. Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale.

Application for Consolidated Sales and Use Tax Filing Number. Any estate that is filing an estate tax return only to elect portability and did not file timely or within the extension provided in Rev. Executors administer an estate under a valid will.

PDF 220KB Fillable PDF 220KB DR-1FA. An estate administrator must file the final tax return for a deceased person separate from their estate income tax return. Executors duties in Florida include taking control of the decedents.

2022-32 may seek relief under Regulations section. As a result of recent tax law changes only those who die in 2019 with. Executors must be over 18 and capable of performing the duties.

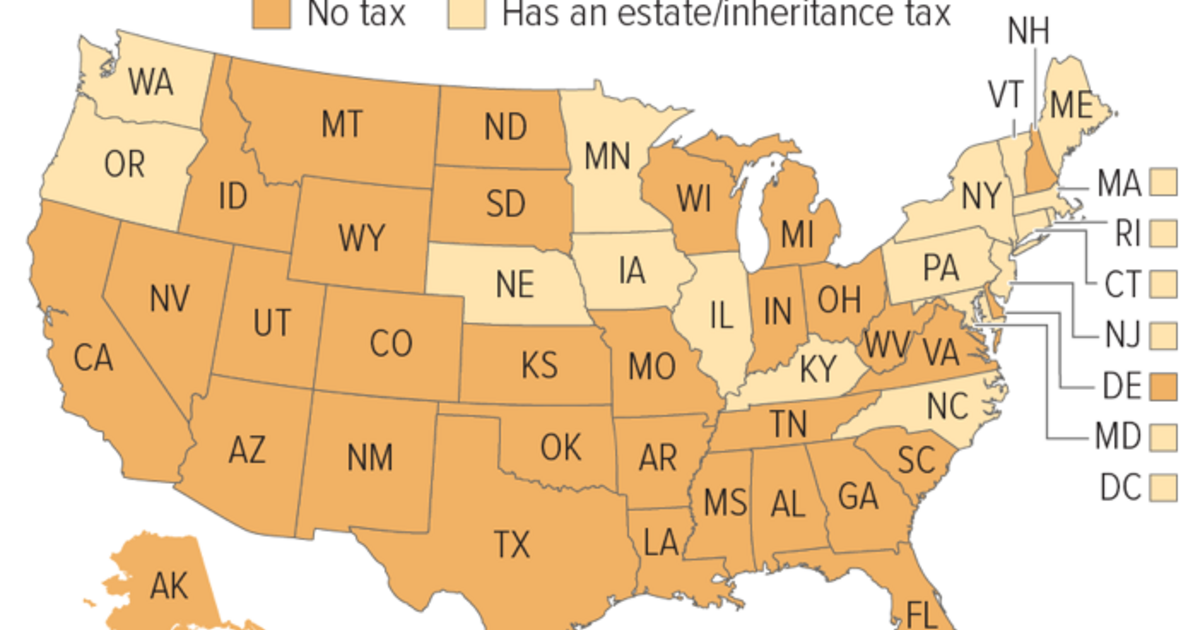

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Florida Estate And Inheritance Taxes Estate Planning Attorney Gibbs Law Fort Myers Fl

Dr219 Fill Online Printable Fillable Blank Pdffiller

Federal And Florida Estate Tax Considerations For Probate Zoecklein Law P A

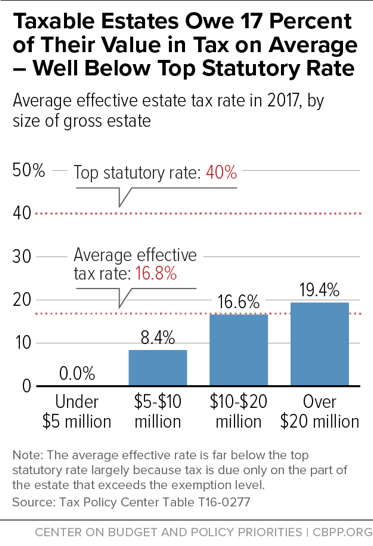

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

Form Dr 312 Download Printable Pdf Or Fill Online Affidavit Of No Florida Estate Tax Due Florida Templateroller

The Ins And Outs Of The Florida Estate Tax The Florida Bar

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

New Irs Data Reiterates Shortcomings Of The Estate Tax Tax Foundation

Florida Estate Tax Everything You Need To Know Smartasset

Does Florida Have An Estate Tax

Estate Tax Planning In Florida The Law Office Of Brian C Perlin P A

Florida Property Tax H R Block

Transfer On Death Tax Implications Findlaw

Form Dr 308 Request And Certificate For Waiver And Release Of Florida Estate Tax Lien R 10 09

Affidavit Of No Florida Estate Tax Due Florida Affidavit Of No Estate Tax Due